How to Prevent Identity Theft During Spring Tax Season

Springtime brings blooming flowers, warmer weather, and unfortunately, tax season. With tax season comes an increased risk of identity theft, a crime where someone wrongfully obtains and uses another person's personal information. It's important to protect yourself against identity theft, especially when filing your taxes. This guide will help you understand how to safeguard your personal information and what steps to take if you suspect identity theft.

Photo By: NY Times

Understanding Identity Theft: Is It a Federal Crime?

Identity theft is indeed a federal crime in the United States. It involves stealing someone's personal information, such as their Social Security number (SSN), to commit fraud or other crimes. The Federal Trade Commission (FTC) and the Internal Revenue Service (IRS) are actively working to combat identity theft, especially during tax season when your personal information is particularly vulnerable. Understanding this helps you realize the seriousness of protecting your data.

Protect Personal Information: The First Line of Defense

The best way to prevent identity theft is to protect your personal information. Here are some steps to help you do that:

Secure Your Social Security Number

Your Social Security number is a prime target for identity thieves. Keep your Social Security card in a safe place and avoid carrying it with you. If you need to share your SSN, make sure it's with a trusted source. Consider asking, "Is it absolutely necessary to provide my Social Security number?"

Monitor Your Financial Accounts

Regularly review your bank and credit card statements for any suspicious activity. Setting up alerts for transactions can help you catch fraudulent charges early. Also, check your credit report at least once a year to ensure accuracy.

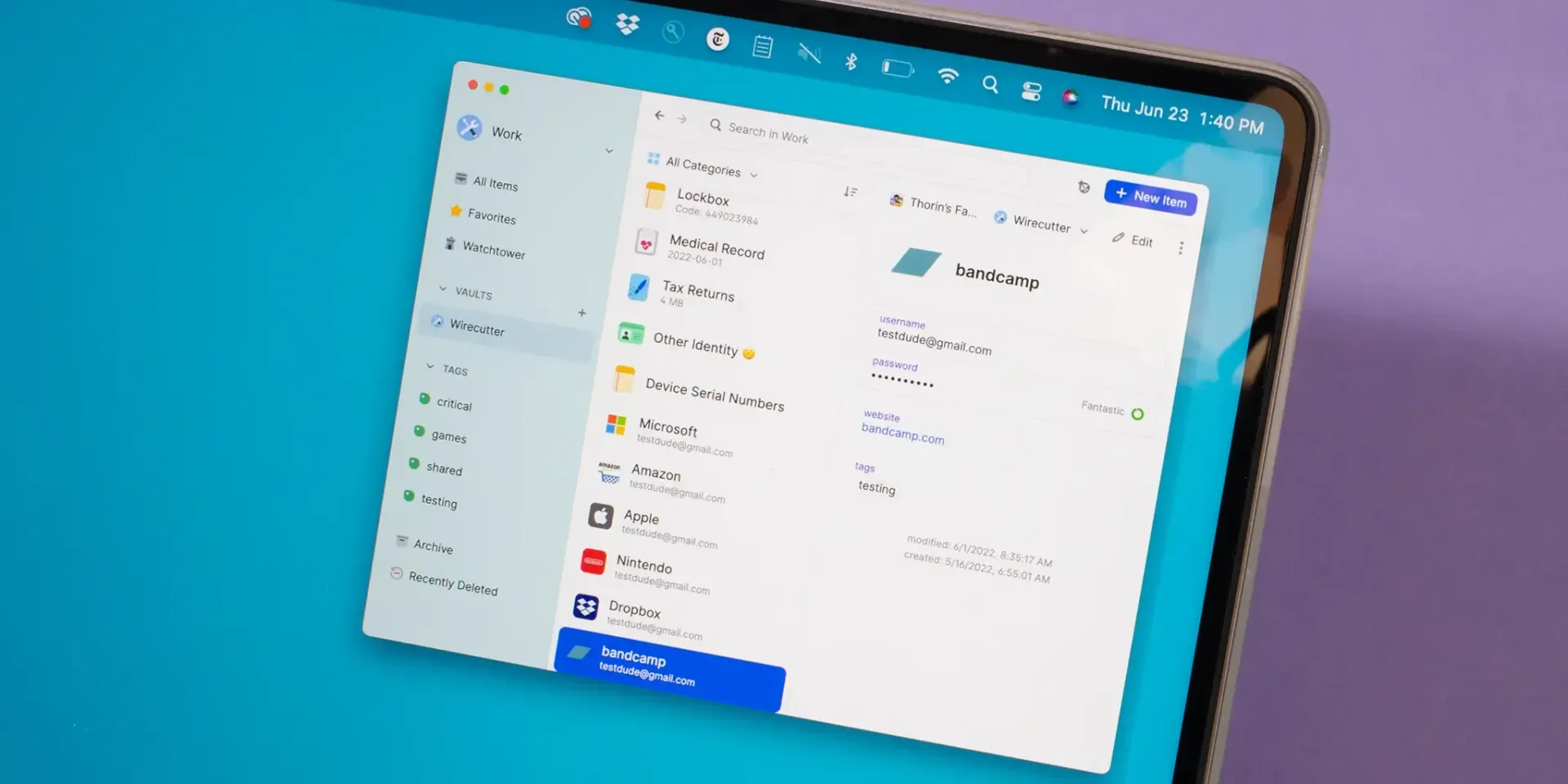

Use Strong Passwords

Create strong, unique passwords for all your online accounts. Avoid using easily guessed passwords like "123456" or "password." Consider using a password manager to keep track of your passwords securely.

Identity Theft Prevention During Tax Season

Tax season is a prime time for identity thieves. Here's how you can prevent identity theft while filing your taxes:

File Your Taxes Early

Filing your taxes early reduces the chance that someone else will file a return in your name. The IRS only accepts one tax return per Social Security number, so beat identity thieves to the punch by filing early.

Use a Secure Internet Connection

If you file your taxes online, ensure you're using a secure internet connection. Avoid public Wi-Fi when accessing sensitive information. Instead, use a private, password-protected network to file your taxes.

Be Wary of Phishing Scams

Phishing scams often increase during tax season. Be cautious of emails, phone calls, or texts claiming to be from the IRS. The IRS will never initiate contact with taxpayers via email or text about a tax bill or refund. Report any suspicious communication to the IRS directly.

Choose a Reputable Tax Preparer

If you hire a professional to prepare your taxes, make sure they're reputable. Check their credentials and ask about how they protect your data. A trustworthy tax preparer will have strong privacy and security policies in place.

How to Lock Your Social Security Number

If you're concerned about identity theft, you might consider locking your Social Security number. Here’s how you can do it:

- Visit the Social Security Administration (SSA) Website: Go to the SSA website and sign up for a "my Social Security" account if you haven't already.

- Request a Credit Freeze or Fraud Alert: Contact the major credit bureaus (Equifax, Experian, and TransUnion) to request a credit freeze or fraud alert. A credit freeze restricts access to your credit report, making it harder for identity thieves to open accounts in your name.

- Consider an Identity Protection PIN (IP PIN): The IRS offers an IP PIN to prevent someone else from filing a tax return using your SSN. This six-digit number is used to verify your identity when filing your tax return.

What to Do If Someone Filed a Tax Return in Your Name

If you suspect that someone has filed a tax return in your name, take these steps immediately:

- Contact the IRS: Call the IRS Identity Protection Specialized Unit at 1-800-908-4490 for assistance. They can help you verify your identity and resolve the issue.

- File a Report with the FTC: Visit IdentityTheft.gov to report the theft and create a recovery plan.

- Consider Filing a Police Report: While not always necessary, a police report can be useful in some identity theft cases, especially if you need to prove the crime to creditors.

Strengthening Your Cybersecurity

Enhancing your cybersecurity can further protect you from identity theft:

- Install Security Software: Ensure your computer has up-to-date antivirus and anti-malware software.

- Enable Two-Factor Authentication: Use two-factor authentication (2FA) for your online accounts whenever possible. This adds an extra layer of security by requiring a second form of verification.

- Stay Informed: Stay updated on the latest cybersecurity threats and scams. Knowledge is a powerful tool in preventing identity theft.

Conclusion

At Underdog Cyber Security, we understand that identity theft is a daunting reality, especially during the tax season when individuals are most vulnerable. By implementing proactive measures to protect your personal information, you can significantly reduce your risk of falling victim to this pervasive crime. Remember, filing your taxes early, regularly monitoring your financial accounts, and enhancing your cybersecurity practices are essential steps in safeguarding your identity.

If you suspect any signs of identity theft, it’s crucial to act swiftly to minimize potential damages. Stay vigilant and informed about the latest cybersecurity threats that could compromise your data.

Don't leave your identity to chance—take action today!

Contact Underdog Cyber Security to learn more about our comprehensive identity theft prevention strategies and how we can help you keep your personal information safe and secure. Your peace of mind starts with the right protective measures—let us guide you in fortifying your defenses.